What is HSA and How Does it Work

A Health Savings Account (HSA) is a tax-advantaged savings account available to individuals enrolled in a high-deductible health plan (HDHP). HSAs are designed to help individuals save money for current and future medical expenses. Contributions to an HSA are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a powerful tool for managing healthcare costs. Understanding how an HSA works is crucial for determining whether teeth whitening expenses can be covered.

Understanding HSA Eligibility

To be eligible for an HSA, you must be covered by a high-deductible health plan, not be covered by any other health plan that is not a high-deductible health plan, not be enrolled in Medicare, and not be claimed as a dependent on someone else’s tax return. It is essential to verify your eligibility before contributing to an HSA. If you are unsure about your eligibility, consulting with a tax advisor or your insurance provider is recommended. Confirming your eligibility ensures you can use the HSA funds without penalty.

Definition of Eligible Medical Expenses

The IRS defines eligible medical expenses as those incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body. This broad definition includes a wide range of healthcare services and products, but it’s crucial to understand that not all medical expenses qualify. Cosmetic procedures, in particular, often face scrutiny. Therefore, before using HSA funds for teeth whitening, it’s important to understand the guidelines and restrictions associated with cosmetic procedures.

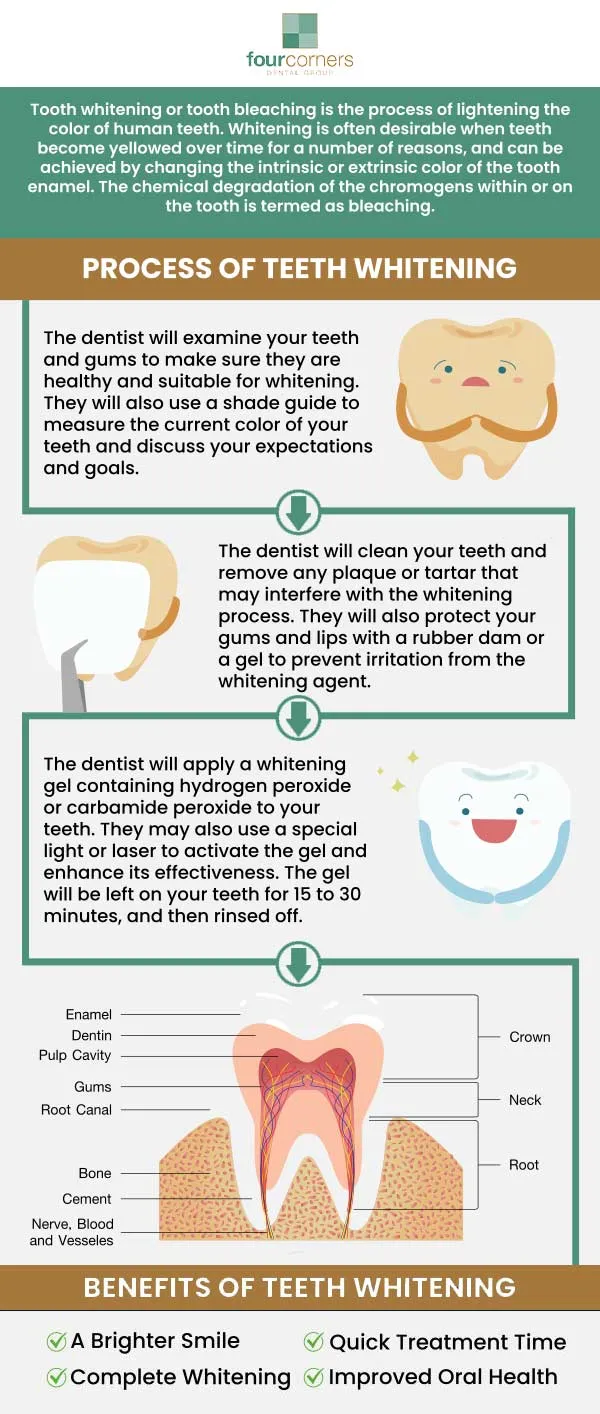

Teeth Whitening and Dental Care

Teeth whitening is a cosmetic dental procedure that aims to lighten the color of your teeth. While it can significantly enhance your smile, it’s generally considered an elective procedure rather than a medically necessary one. Understanding the distinction between cosmetic and medically necessary procedures is critical when determining HSA eligibility. Many dental procedures are covered by HSA, such as fillings, root canals, and other procedures that are essential to maintain your oral health, but teeth whitening does not usually fall under the list.

Is Teeth Whitening a Medical Expense

Generally, teeth whitening is considered a cosmetic procedure and is not typically deemed a medical expense by the IRS. Because the primary purpose is to improve appearance rather than treat a specific medical condition, it is not generally eligible for HSA reimbursement. However, there might be rare exceptions where teeth whitening could be considered medically necessary, for example, if it is part of the treatment plan for a specific medical condition. Always consult with a dental professional for clarification.

IRS Guidelines on Cosmetic Procedures

The IRS has specific guidelines regarding cosmetic procedures and HSA eligibility. According to these guidelines, expenses for cosmetic procedures are generally not considered medical expenses. This includes procedures that improve appearance but do not treat a disease or illness. However, there are exceptions if a procedure is necessary to correct a condition caused by an accident or a disease. It’s essential to review the IRS guidelines and consult with a tax professional to understand the specifics.

Teeth Whitening Treatments and HSA

Teeth whitening treatments come in various forms, each with its own cost and method. The type of treatment you choose can affect your HSA eligibility. The following section describes common types of teeth whitening treatments.

In-Office Teeth Whitening

In-office teeth whitening is performed by a dentist and is one of the most effective methods. The dentist applies a high-concentration bleaching agent to your teeth and uses special lights or lasers to accelerate the whitening process. This method typically yields immediate and dramatic results. Since this is a professional treatment, and considering that teeth whitening is not usually HSA eligible, it’s unlikely that this type of procedure will be covered by your HSA.

At-Home Teeth Whitening Kits

At-home teeth whitening kits include custom-fitted trays or strips containing a lower concentration of bleaching agents. These kits are more affordable than in-office treatments and can be used at your convenience. While cost-effective, at-home kits are still considered cosmetic, and generally, HSA funds cannot be used to pay for them. Some kits might be available over-the-counter, which also impacts eligibility for reimbursement.

Over-the-Counter Whitening Products

Over-the-counter (OTC) teeth whitening products, such as whitening toothpaste, strips, and gels, are readily available and the most affordable option. Since these products are used for cosmetic purposes, it is highly unlikely that they would be eligible for reimbursement from an HSA. Always check with your HSA provider to confirm eligibility before making a purchase.

Documentation and Claiming Process

Even if teeth whitening might be eligible under specific circumstances, proper documentation is always necessary when submitting claims for HSA reimbursement. The process for claiming these expenses involves providing specific documents to support the claim. To ensure a smooth and successful claim process, it’s essential to be prepared with the required documentation.

Required Documentation for HSA Claims

To claim teeth whitening expenses through your HSA, you will need to provide a detailed receipt or invoice from your dentist or the provider of the teeth whitening products. This document should clearly state the services rendered, the date of service, and the amount paid. You may also need a letter of medical necessity from your dentist, if applicable. This letter should explain why the teeth whitening was required for medical reasons. Always keep copies of all the documentation for your records. Also, save all receipts and invoices related to teeth whitening.

Steps to Claim Teeth Whitening Expenses

The claiming process typically involves completing a claim form provided by your HSA administrator and submitting it along with the required documentation. You may need to provide details about the service and the amount you paid. Some HSA providers allow you to submit claims online, while others require you to mail in your paperwork. Check with your HSA provider for specific instructions on how to submit a claim. Always retain copies of everything you submit for your records.

When Teeth Whitening Might Be HSA Eligible

Although teeth whitening is typically a cosmetic procedure, there are limited situations where it might be eligible for HSA reimbursement. Understanding these exceptions can help you assess your situation and determine if you can use your HSA funds. It’s important to remember that these situations are rare and require supporting documentation from a medical professional.

Teeth Whitening for Medical Reasons

In rare cases, teeth whitening might be considered medically necessary. For instance, if teeth discoloration is caused by a medical condition, a medication side effect, or an accident that has affected the enamel, teeth whitening could be considered a treatment. Always seek a professional opinion. If your dentist or doctor determines that teeth whitening is medically necessary, they can provide a letter of medical necessity, making it more likely that the expense will be HSA eligible.

Examples of Medical Necessity

Examples of medical necessity that might make teeth whitening eligible for HSA reimbursement include discoloration caused by trauma, certain medications, or specific medical treatments. For example, if the discoloration is caused by medications, and the teeth whitening procedure helps restore the original tooth structure, it could be considered medically necessary. The most important step is to consult with your dental or medical professional and get documentation explaining the medical reason for the procedure. Without medical necessity, teeth whitening is unlikely to be covered by HSA.

Alternatives to Teeth Whitening

If teeth whitening is not HSA eligible, there are other dental procedures and preventative care options that may be covered. Some dental treatments are medically necessary and are often eligible for HSA reimbursement. Considering these alternatives can help you maintain your oral health while maximizing the benefits of your HSA.

Other Cosmetic Dental Procedures

Many other cosmetic dental procedures are available, such as veneers or dental implants. However, most cosmetic procedures are not considered essential, and are unlikely to be HSA-eligible unless they are deemed medically necessary. Always confirm with your HSA provider and consider the underlying reason for the treatment. Some of these procedures might be included as part of a treatment plan that addresses a medical need, which could affect the eligibility.

Preventative Dental Care

Preventative dental care, such as regular check-ups, cleanings, and fluoride treatments, is often HSA eligible. Maintaining good oral health can prevent future, more expensive dental treatments. Regularly visiting your dentist for check-ups is an excellent way to maintain your oral hygiene. Regular cleanings and examinations are often HSA eligible. Investing in preventative care is a smart way to maximize your HSA benefits and maintain your dental health.

Final Thoughts and Tips

Understanding the rules surrounding HSA eligibility for teeth whitening can help you make informed decisions about your healthcare spending. Here are some tips to help you manage your HSA effectively and explore the possibilities that fit your needs.

Maximizing Your HSA Benefits

To maximize your HSA benefits, save all receipts and documentation related to your medical expenses. Make sure you understand which procedures and services are eligible, and always verify eligibility with your provider. Consider using your HSA for eligible expenses like doctor’s visits, prescription medications, and other healthcare costs, including preventative care. Plan your healthcare spending strategically to get the most from your HSA.

Where to Find More Information

For further information about HSA eligibility, consult with your HSA provider, a tax advisor, or a financial planner. The IRS website also provides detailed information about eligible medical expenses. Additionally, consult your dentist to discuss any dental procedures, including the potential medical necessity of teeth whitening. Make sure to always consult reliable sources and keep updated about the regulations.